What Happens After Investing at All Time Highs?

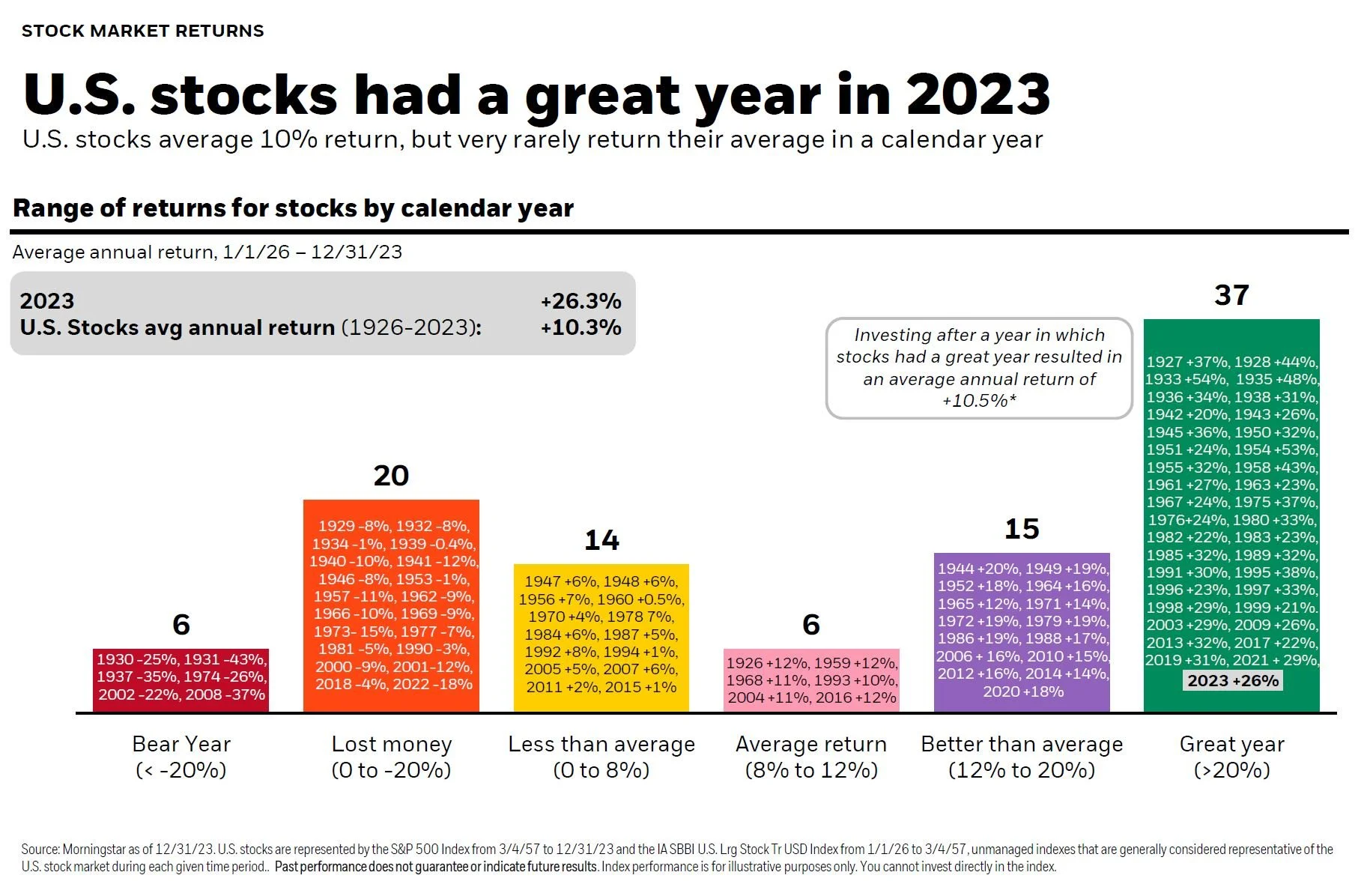

After rallying 20% in 2023, the U.S. stock market is now within striking distance of its 2021 all-time highs. When you read “stock market at all-time highs”, you probably expect a crash to follow shortly after. I’m not sure that’s something to worry about:

History suggests that after a 20% surge, the market's next move is often...up. Of the 34 times the S&P 500 gained 20% or more, 22 of the following years saw positive returns, averaging +8.9%.

All-time highs are more common than you’d think: the S&P 500 has historically spent nearly 5% of its trading days making new all-time highs. That’s more than once a month!

JP Morgan Did some research and found that all time highs tend to be better days to invest than the “average” day. Why? One explanation might be that positive momentum is a difficult thing to derail.

Finally, it’s worth considering how often the market grows. After all, companies continue to strive for profits year after year, and successful ones see earnings growth considerably over time. With that in mind, here’s the chart of nearly 100 years of market returns…