5 Compelling Reasons Retirees Should Consider Investing in Dividend-Paying Stocks

We all know money can’t buy happiness, but it can buy two reasonably close things: Time and Freedom. Retirement is the ultimate symbol of both- If you’ve saved up enough, eventually you won’t need to trade your time for a paycheck. Retirement happens, as the saying goes “When you have enough, and you’ve had enough”.

However, that freedom often comes with financial insecurity. Do you ever wonder:

• What if I outlive my money?

• If I invest, how do I minimize risk?

• How do I keep pace with inflation?

• How do taxes work?

If you’re like most people, you can’t afford to keep your retirement savings under the mattress. Often, what you’re looking for are investments that offer both stability and a steady stream of income.

One investment strategy that can provide both is ownership of dividend-paying stocks. Here are five reasons why dividend-paying stocks can be a fantastic addition to a retirement portfolio:

1. Mark Your Calendar:

Shareholders enjoy a portion of the company's earnings, which are often distributed quarterly or even monthly. Successful companies can keep this up for decades or longer; there’s even a list of “Dividend Kings” which have paid and increased dividends for 50 years in a row

2. The Income-Tax Loophole:

Most people don’t realize that a married couple can earn up to $83k in qualified dividends (after their standard deduction) without owing any federal income tax. Above that, they only pay 15% on the next $400k of income.

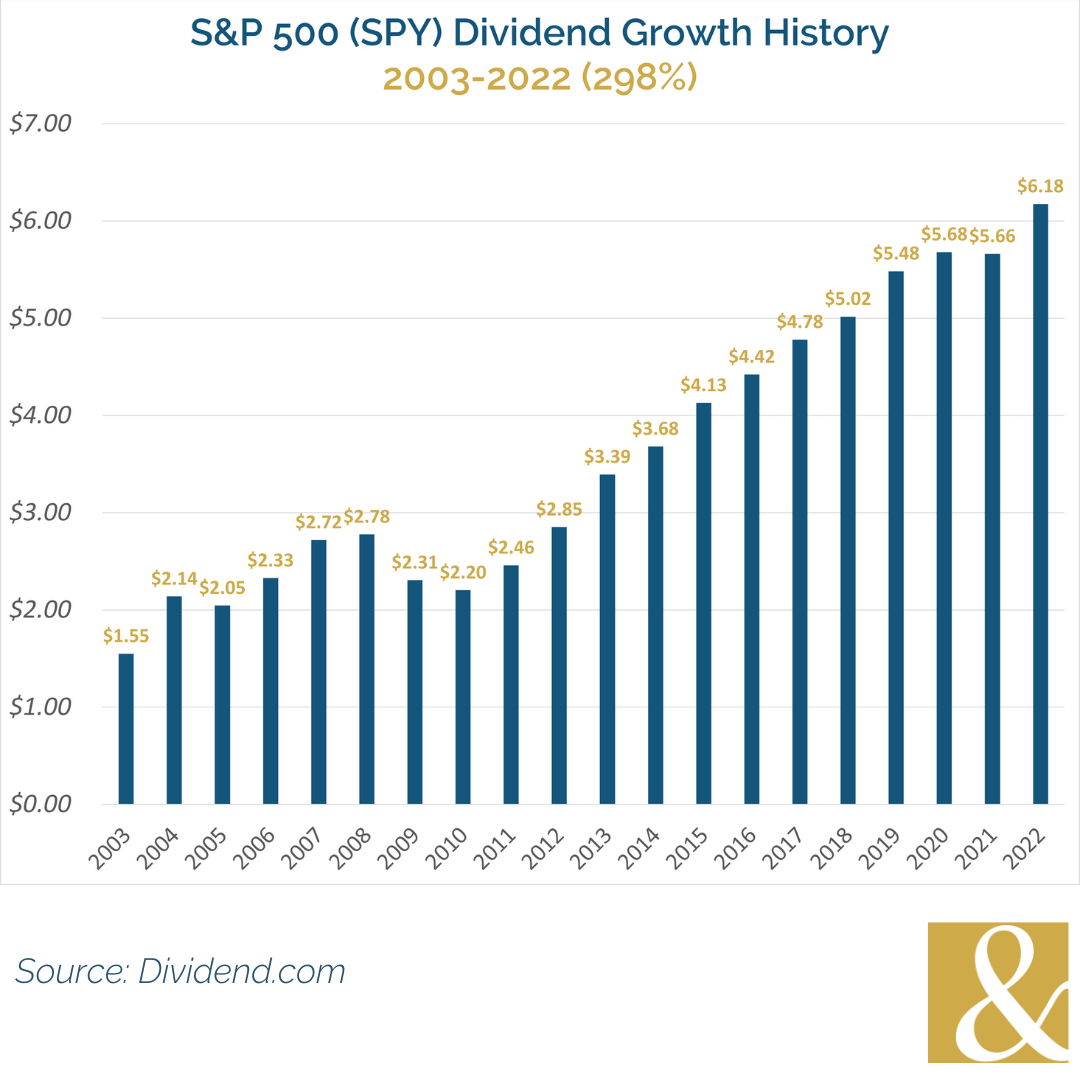

3. Inflation Protection:

Dividend-paying stocks are historically one of the greatest ways to protect your paycheck from inflation. In 2022, while inflation touched 8%, the average dividend payer increased its payout by over 10%.

4. They’re Not A Stick in the Mud:

While they don’t offer as much upside potential as high-growth stocks, they still have appreciation potential. As Warren Buffett says, “If a business does well, the stock eventually follows.”

5. A Smoother Ride:

Dividend-paying stock prices tend to be more stable than non-dividend payers. While not completely immune to market swings, people are generally more hesitant to sell off their dividend-payers.

Every investment strategy comes with risk, including stocks. But there are potential benefits and plenty of upside worth considering. On their appreciation potential, one advisor writes: “Retirees should only avoid stocks if they hate their children and charity”.

If you’d like to discuss Planning for Retirement, you can read more here, or schedule a free appointment online today 😊.